Renting Out, Reverse Mortgages and Retirees

With official retirement age at 62, CPF withdrawal at 55, life expectancy at 82, inflation, and less reliance on children for support, retirees don’t have it easy. Stopped work earlier, restrictions on CPF withdrawal because of the minimum sum and longer life all means a drain on savings post-retirement. There are ways out for retirees living in HDB flats, but they have to undergo some painful mindset changes to get out of the asset-rich cash-poor corner they are in.

Assuming they don’t have an annuity plan and investments to provide for them ie. they had weak financial planning because of their misplaced faith in the PAP to take care of them, if they stay in HDB flats, they can sublet a room. But the main reasons why they don’t are that they want privacy (54%) and there is no spare room to rent out (39%).

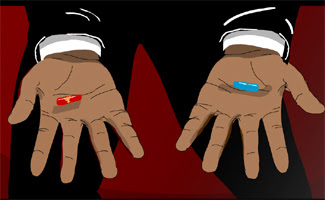

Downsizing, not “downgrading”, is one alternative to have cash in the pocket, selling off and buy a smaller cheaper unit, provided that the retirees are already not staying in a studio flat already. However, older citizens usually abhor change to another home, especially if it is one smaller and there is a loss of face in living in a smaller unit, $20,000 Silver Housing Bonus dangled in front of their face or not.

More adventurous retirees can dabble in reverse mortgages provided they understand the risks. They can get cash monthly from a bank, seen as an annuity as the homes are the collateral to be sold off at the end. The catch, there is no free lunch, is that if the valuation of the property price dropped once they have a reverse mortgage deal, they might have to top up to bring it back to the 80% thereabouts LTV when the took the deal, which is usually ridiculous to expect of retirees. They took the reverse morgtage because they needed cash in the first place.

A mindset change is fundamental among retirees if they want to monetize their homes. They have to understand the trade-offs and compare among the reverse mortgage, lease buy back, downsizing and renting out back up plans. The government in turn has the responsibility to educate and offer easier to understand options. In the end, whose fault is it? We don’t even need to look at these home monetisation schemes, some of it more complex than others. SRS is another example of a misunderstood plan despite its benefits.

Pingback: Daily SG: 7 Jun 2013 | The Singapore Daily

Pingback: New subletting quota likely to affect Simei, Yishun, Bt Merah first – Channel News Asia | Singapore Property Rental